HOW TO WIN LOYALTY FROM PREPAID CUSTOMERS WITH AUTOMATIC TOP-UP

How to win loyalty from prepaid customers with automatic top-up Schedule a callAutomatic top-up is the ultimate in convenience for pay-as-you-goers, and a great way to inspire loyalty from a customer base not known for its faithfulness.

For the telecom service provider, automatic top-up is the secret sauce for getting the most value out of those who really help build profits: repeat customers.

According to SumAll, businesses with 40% repeat customers generated nearly 50% more revenue than similar businesses with only a 10% repeat customers.

It’s tough to argue with the considerable benefits of automatic top-up: a longer customer lifetime value, higher ARPU (Average Revenue Per User), increased customer satisfaction and reduced customer churn.

But it’s not just the telecom service provider who gets all the advantages. So do prepaid customers.

Whether it’s parents arranging an auto balance to ensure their children don’t run out of credit when they’re out and about with friends, a retiree who’s uncomfortable with technology and struggles with manual top-up, or teenagers who can’t take out a contract because of their age but would love to have recurring data bundles.

Whichever way you look at it, automatic top-up is a convenience product that will encourage repeat buys and command brand loyalty. So, here is our guide to the service that we think all mobile service providers should be offering their prepaid customers.

What is automatic top-up?

Automatic top-up is crediting a mobile phone’s prepaid account on a recurring basis. The customer gives the mobile service provider permission to withdraw a payment automatically on a pre-determined basis, using the customer’s preferred payment method.

A customer who has purchased from you only once has a 27% chance of visiting again, but someone who has made three purchases has a 54% chance of making a fourth purchase.

Source: SumAll

By saving customers the trouble of keeping a close eye on their balance, you’re removing their worries about running out of minutes or data when they least expect it. You’re also saving them time and hassle because they won’t have to top up manually online or instore.

The 3 types of automatic top-up

Generally speaking, there are three types of schemes for topping up the accounts of prepaid customers:

Account balance level

A customer mandates a provider to automatically top up each time the balance falls to a certain limit, say €3.

On a date, day or periodic basis

For example, on the first of every month, three days prior to the plan’s expiry date, or every four weeks.

Recurring bundles

Recurring bundles are automatically purchased and activated whenever the current bundle expires.

Things to consider when designing your auto top-up plan

Top-up amounts

You’ll also probably want to set a monthly maximum amount. This is a great way for individuals to manage their finances. For example, one customer may choose €15 per top-up and no more than €30 per month, while another may prefer €30 per top-up and no more than €90 per month.

Make it easy for people to change their set amounts and limits at the click of a button. If customers know they can’t exceed their monthly budget, they’ll feel much more comfortable about using their prepaid plan to its full extent.

You’ll also need to determine a minimum account balance to avoid any possible disruption to your customer’s service.

Top-up periods

Some customers will want to set a regular day or date to top up their mobile, so you need to establish a payment calendar (e.g. daily, weekly or monthly). Other customers will want to top up as soon as their balance reaches a certain limit, regardless of the date. You may want to follow the example of Telekom and offer a combined option: as soon as payment for the prepaid plan is due or credit is not sufficient, whichever is the sooner.

Think carefully about matching top-up periods with credit periods. If a customer’s credit is valid for, say, only 28 days, you don’t want to offer a top-up period on a specific date, say the 1st of every month. That may result in the customer not having credit for two or three days for eleven months of the year, and you don’t want that to happen

Notifications

Most providers send their customers a confirmation by text and/or email every time their account has been topped up automatically. You may also decide to notify them shortly before a payment is withdrawn or when their balance reaches a certain point (sometimes called a courtesy alert).

Customers appreciate being kept informed. One, it reassures them that their account has been topped up. Two, they can make sure funds are sufficient to cover the payment.

You may also want to consider including itemized credit and data usage in your notification. This transparency will reassure customers that you’re not topping up unnecessarily.

Payment methods

The payment methods offered for automatic top-ups vary greatly between mobile service providers and the countries in which they’re located.

Payment by credit card is possible with most providers, but residency restrictions may be in place. For example, Virgin Mobile Canada accepts MasterCard, Visa or American Express credit cards issued in Canada for its auto-pay service, but it doesn’t accept domestic debit cards and prepaid credit cards or credit cards issued in another country.

O2 UK lets you top up automatically using PayPal and any major credit or debit card except Diners and Electron, regardless of the issuing country, whereas O2 Germany and T-Mobile Netherlands ask their customers to pay automatically via a SEPA direct debit (SDD).

Deutsche Telekom, on the other hand, offers three popular payment methods: credit card by Visa or Mastercard, PayPal and SEPA Direct Debit.

Globally, 29% of PayPal transactions are done on a mobile device. Although the traditional payment method was on desktop, most of the growth that PayPal experiences is coming from mobile.

Source: Ecommerce Payment Methods Report 2016

SDD is a Europe-wide standard for collecting funds between a debtor (the customer) and the creditor (the seller). Roughly 34 countries and territories have signed up to the SEPA scheme. It’s a pull-based scheme, meaning the customer gives the seller a (e-)mandate to collect payments from his or her bank account.

PayPal is an extremely popular recurring payment method offered not just by mobile service providers, but also by many sellers of digital goods. The great advantage of PayPal is that it is used and trusted by millions around the world, so it enables you to reach a wider, international audience.

Even in the Netherlands, where iDeal is the dominating online payment method, PayPal is now recording more than 2 million (11%) account holders all over the country in 2021.

However, PayPal’s dominance in the mobile payment market might be coming to an end or at least it’s being challenged. Huge smartphone, technology, and social media companies are penetrating the mobile payment market by introducing integrations, which serve as tools to pay bills digitally.

For this exact reason, companies are strongly advised to re-consider their supported payment options, since the emerging methods are getting more and more popular among the users.

Changes & cancellation policy

The easier you make it for customers to cancel or change, the likelier they are to adopt automatic top up in the first place. Remember, prepaid clients love the freedom of having no contract, so you don’t want to tie them down with a cancellation policy that is too restrictive.

Incentives

A well-targeted incentive may be just the encouragement your customers need to sign up.

AT&T in the US offers savings of up to $60 a year with its AutoPay service (the higher the plan, the higher the savings).

TIM in Italy offers free Social & Chat on all major social and chat platforms for the first two months.

Virgin Mobile Canada offers an extra 10% bonus credit every time the account is topped up with a credit card.

O2 UK adds up all a customer’s top-ups every 3 months and gives back 5% or 10% as shopping credit.

What’s the best way for customers to enrol for automatic top-up?

When it comes to enrolment, the best approach is to give customers a range of options, including going to your retail store (if you have one) and dialling a customer service number from their prepaid device.

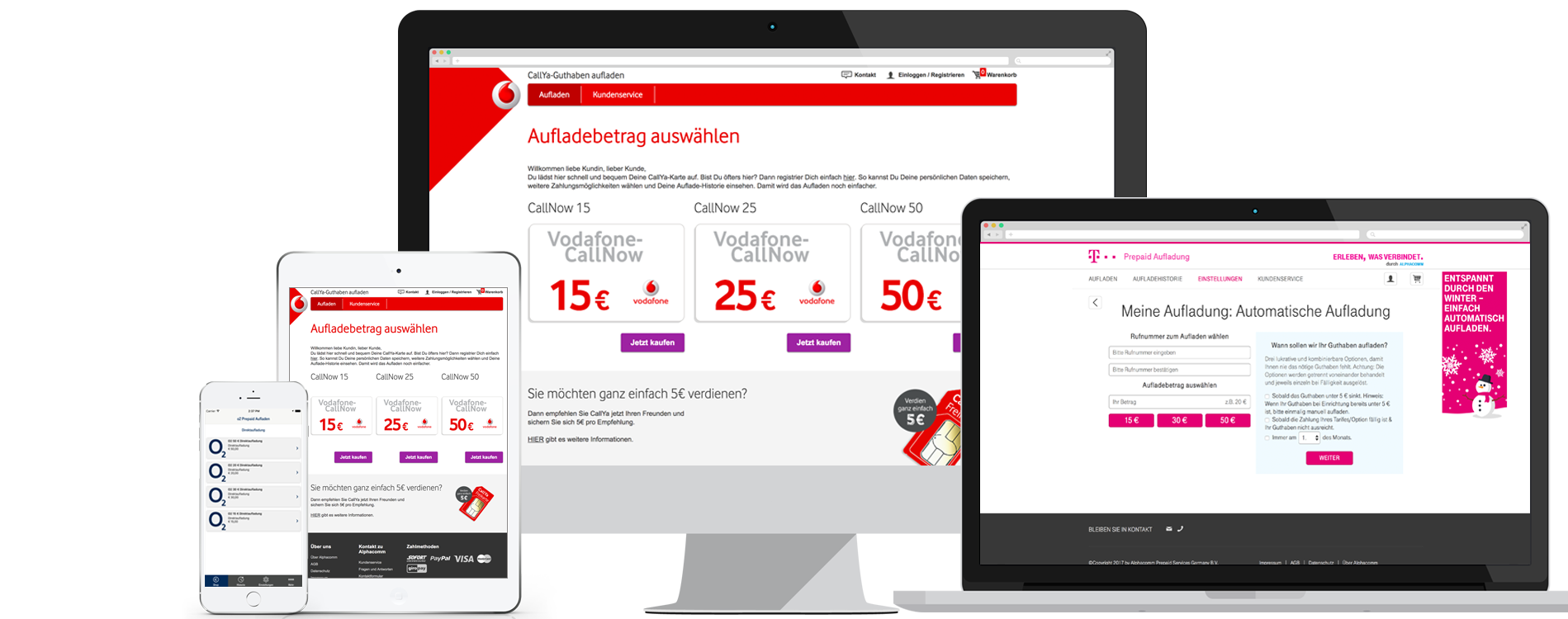

But the most effective options are undoubtedly via your website and branded app. Why? Because these self-service tools keep conversion friction to a minimum. There’s no having to trudge through the wind, rain or snow just to queue up in a store that you’ve waited to open. Likewise, there’s no holding on the line and listening to piped music while waiting to speak to a customer service representative.

In other words, your website and app make the registration process as effortless as possible, which increases substantially your chances of getting customers to sign up.

Most mobile service providers require customers to first log in to the customer portal to set up their automatic top-up. This is understandable. Customer portals (My Account) are great in helping with onboarding customers because they give them all the resources they need, including instructions, user manuals and training videos. So, they’re a natural place to have your auto-top-up registration screen.

What’s more, by directing customers to My Account, you won’t have to ask again for personal information like name and address. You’ll have most of the data you need already in the customer ID profile. All customers need do is choose their top-up amount and preferred payment method and enter their payment details.

Bearing in mind that one of the goals is to keep conversion friction to a minimum, it’s worth considering Social Login so that your customers can access your portal using their social network credentials. From a customer’s perspective, the inconvenience of creating a unique username and password that must be remembered is avoided.

From a business perspective, it overcomes the reluctance that some customers have of sharing personal information with yet another website and it enables you to mine their social data. This is a tremendous benefit. It gives you the opportunity to learn more about your customers, identify their preferences, and match your products and services with their needs and expectations.

And that helps you refine your acquisition and retention strategies.

You’ll also need to determine a minimum account balance to avoid any possible disruption to your customer’s service.

How many payment methods should you offer?

Numerous studies support the strategy of offering several payment methods to online shoppers. Ideally, e-retailers should offer a mix of global and local options.

Especially after COVID-19 pandemic and exponential growth of ecommerce, consumers found out new, innovative ways of paying their bills. In addition to the traditional credit card, businesses could include real-time bank transfers, e-wallets, mobile wallets, direct debits, prepaid cards, electronic cash payments, local card schemes and pay-out services, all of which vary in popularity according to region and country.

To maximize your conversion rates (and consequently increase your revenues and profits), take into consideration local preferences by offering locally appropriate payment options alongside the most popular global payment methods.

2.13 billion euros are lost annually in the UK, due to lack of payment methods supported by the merchants. Also, it was found that 67% of customers are frustrated when they notice a lack of payment methods.

Source: Ecommercenews

Final thoughts

Back in 1990, Frederick Reichheld of Bain & Company carried out startling research proving

what traditional service companies have known for decades: that customer loyalty has a massive impact on the bottom line.

Reichheld showed that increasing customer retention rates by 5% increases profits by 25% to 95%. In other words, without improving long-term customer loyalty, you can’t boost long-term profits. This philosophy, which still holds true today, applies just as much to sellers of digital goods as it does to brick-and-mortar stores.

As a provider of mobile services, you’re always on the look-out for ways to increase average revenue per user, command brand loyalty and maximize customer lifetime value. Providing an automatic top-up service to prepaid customers goes a long way to raising customer satisfaction rates and, at the same time, lowering the threshold to becoming a postpaid customer.

If you found this article informative, please share it with your colleagues. If you’d like to chat to one of our experts about your payment fraud concerns, please give us a call on +31107989501.

About Alphacomm

Alphacomm is a global partner in all top up, reminder, dunning and payment challenges. Checkmaxx, our digital goods solution, helps companies maximize their conversion rates by letting customers top up their prepaid accounts whenever and wherever they want. If you’re ready to give your customers the ultimate top-up convenience and boost brand loyalty, call me today to schedule a free consultation.

Let's make it happen!

Say Hello!

Address

Scheepmakerspassage 183

3011 VH Rotterdam

The Netherlands

Business

Follow us

Address

Scheepmakerspassage 183

3011 VH Rotterdam

The Netherlands

Business

Follow us

© Copyright Alphacomm B.V. | Made with <3 in Rotterdam