Self-service

How a customer-centric approach to credit management, reduces costs & shortens payment delays Schedule a callA brief introduction

In Europe, late payments are on the rise, due to COVID-19 pandemic aftermaths, such as rapidly growing inflation. In 2022, the average payment time for consumers was 33 days. For B2B and the Public Sector, average payment times were 52 days and 62 days respectively. Such numbers represent an exponential increase if compared to 2019 figures, which are 23 (B2C), 34 (B2B), and 42 days (Public Sector) respectively. For businesses of all sizes, late payments are a threat to cash flow and overall financial stability.

The truth is that many customers in arrears, would actually like to pay but are unable to do so. The way we approach customers, does a lot to shape how they perceive our businesses.

If done right, proper debt collection can become a means to boost customer satisfaction and extend the customer life cycle.

At a time when more businesses are solely turning to data and algorithms to ease the pain of payment collection, this whitepaper introduces a new, more humane and hybrid approach to collecting outstanding payments. An approach that centres on involving customers and providing them with the necessary tools and options to make informed decisions.

The endless depths of consumer debt

All around the world, consumers are in debt. In many cases even problematic debt. Though the exact reasons may vary, one thing is certain: being in debt affects society as a whole.

The Netherlands is one of Europe’s most affluent countries. However, in October 2021, more than 620,00 households (7.6% of the total), had registered problematic debts (ABN Amro, 2022). It is estimated that 1.5 million Dutch households (i.e. almost one in five households) have problematic debts or are at risk of such debts. Moreover, there are 300,000 working poor living in the country (Schuldenlab, 2019). These are people who, despite working, still have an income that falls short of the poverty line.

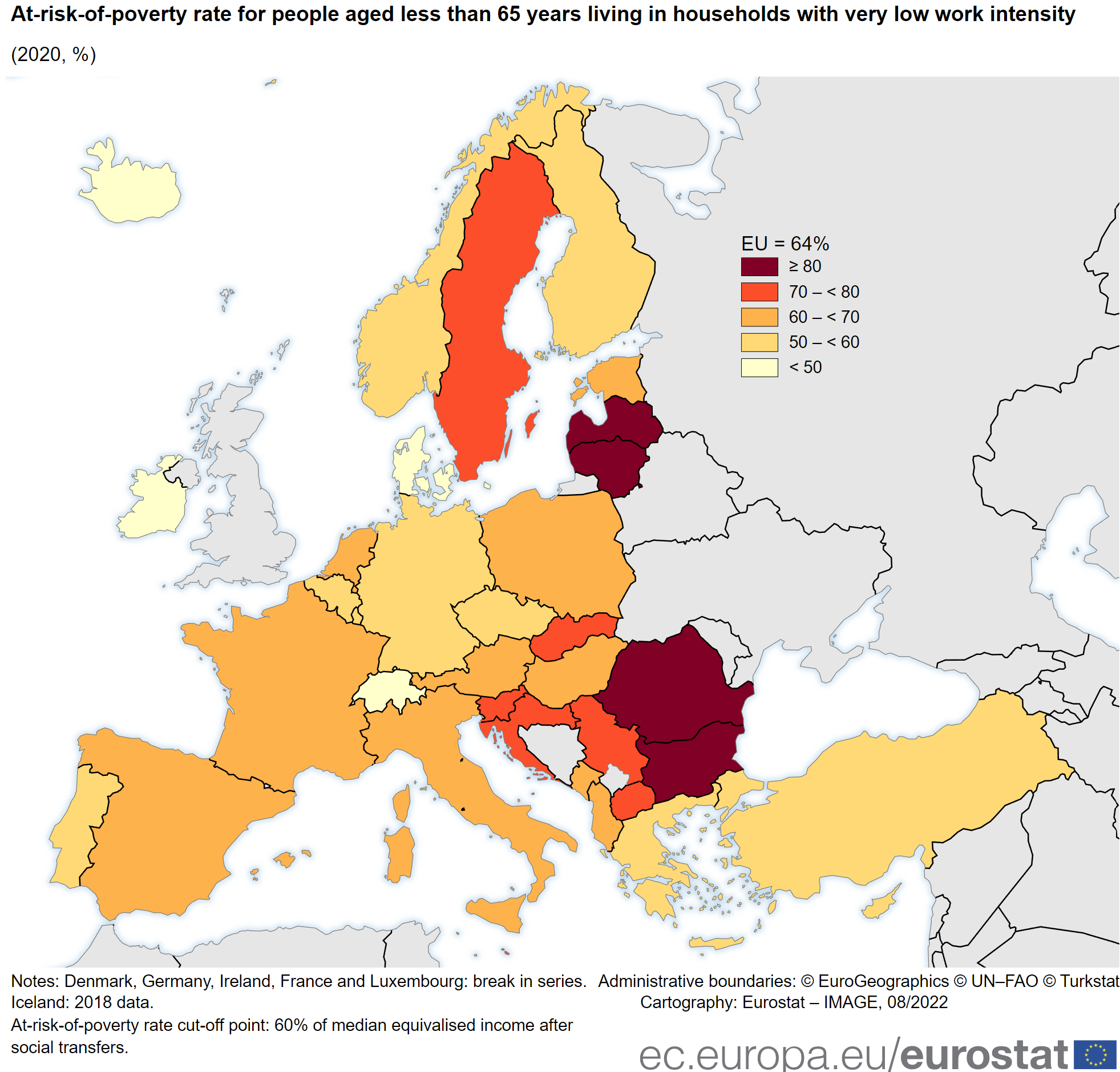

In fact, across Europe, 64% of people living in very low work intensity households are at risk of poverty. Though on the decline since 2021 (63%), personal debt in the Eurozone still stands at 59.4% in 2022. In the USA and the UK, the figure is 69.5% and 89.6% respectively.

Persons with low levels of literacy are at higher risk of incurring high debts.

In the Netherlands, 2.5 million people have difficulty reading and writing. Within this group, 50.3% struggle with problematic debts. Yet, in spite of this jarring statistic, payment reminders are usually still sent in the same traditional fashion as always; in writing and, more often than not, by letter.

People with low literacy and debt tend to have difficulty understanding the content of such letters. Moreover, having difficulty reading means that debtors sometimes also have difficulty communicating with the organizations and/or agencies to which they are indebted. They aren’t always able to provide the requested information in the way suggested by the creditor, and speaking to a customer service representative via telephone might even add to the confusion.

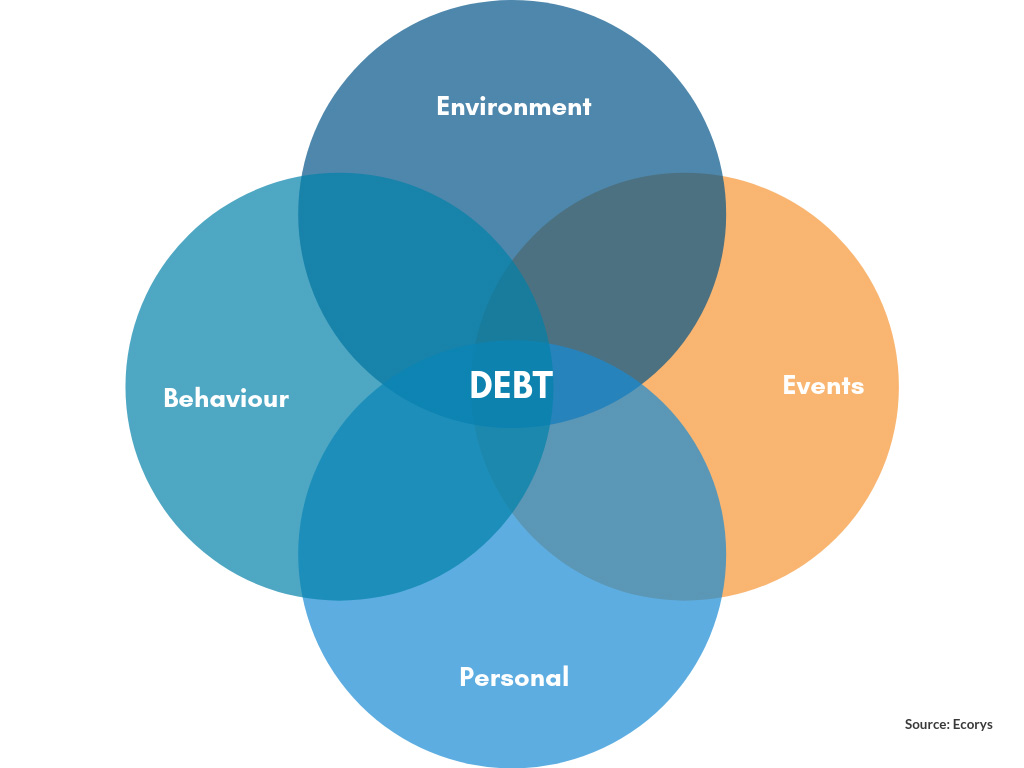

Properly understanding debt, and its causes, requires us to take an even broader look at the problem.

Debt does not discriminate. While people with low literacy are over-represented in debt studies, that still doesn’t really explain why so many people are bogged down by problematic debt.

Debt arises from a combination of causes. These can be divided in four clusters:

- Environment: External factors that are beyond the control of the person. These include the person’s economic situation, the complexity of society, administrative errors by creditors, etc.

- Behaviour: Factors include short-term thinking, poor financial skills, insufficient knowledge of financial products, etc.

- Events: These are major life-events like unemployment, divorce, illness, etc.

- Personal: Personal (internal) factors the person has no control over, like illiteracy, mental disability, etc.

The new role of business

No matter the size of your business, non-paying customers are a problem. The way we handle these cases says a lot about how we see our role in society.

Nowadays, many businesses are relying on data and algorithms to make payment collection processes easier. Machine Learning and Artificial Intelligence have become popular buzzwords, with good reason.

But when it comes to debt, the devil is in the details. Data-driven collection models are only part of the solution.

By relying too heavily on data aggregation and pattern recognition, many mistakes are made.

If an otherwise successful person were to suffer a financial setback due to employment issues or divorce, the impact on that person’s cash flow would be huge. Unfortunately, such sudden changes aren’t detected nor properly understood by algorithms.

Another shortcoming of relying on data is that little or no attention is paid to the willingness of the debtor to solve the problem. Most people in debt actually do want to pay their bills.

If only they had options …

Self-Service in credit management

The most effective approach to payment collection is self-service. Why? Because it puts the user in the driver’s seat and relieves the pressures often associated with debts and debt collection.

As previously shown, there are myriad reasons why some customers pay late and others never pay at all.

Many simply forget, some might have prioritized bigger bills and postponed yours, while others might be up to their necks in crippling debt.

Devising a perfect solution to late and non-payment challenges requires businesses to recognize that all situations are different.

Different levels of literacy, media consumption, cultural backgrounds and employment situations may all affect your customer’s ability or willingness to follow payment instructions.

When it comes to debt, many feel powerless. The self-service approach ensures that consumers are provided with options. These are clearly defined options that put the customer back in the driver’s seat. How?

The self-service approach

#1 Pay directly

Some people might have forgotten they had an unpaid bill. In this case, they could click to pay directly in full.

#2 Pay later

Others might not have the cash at the moment, but will be able to pay when they get their salary. They could choose the pay later option.

#3 Pay in instalments

Some have low cash flow or crippling debt. For them, paying the bill in full is impossible. Instead of ignoring it, they could click to pay in instalments. By making regular payments from day one, they avoid being charged late fees that make their situation worse.

#4 File an objection

Some customers might not have paid on time because they simply do not agree with the charge. These clients could opt to file an objection.

#5 Get help

Others, might have difficulty grasping the situation. They could use the information you provide to get in contact with a customer service representative or debt counsellor.

Interactive video landing pages

Within a self-service approach, the general goal is to speak to your customers in a way that helps them truly and fully understand the situation they are in and the options available to them. Unsurprisingly, communicating with debtors is most effective and efficient if you approach them through their preferred channels.

The main tools to include in your arsenal are voice messaging, SMS, E-Mail, QR codes, video, digital assistants or a strategic combination of all the aforementioned.

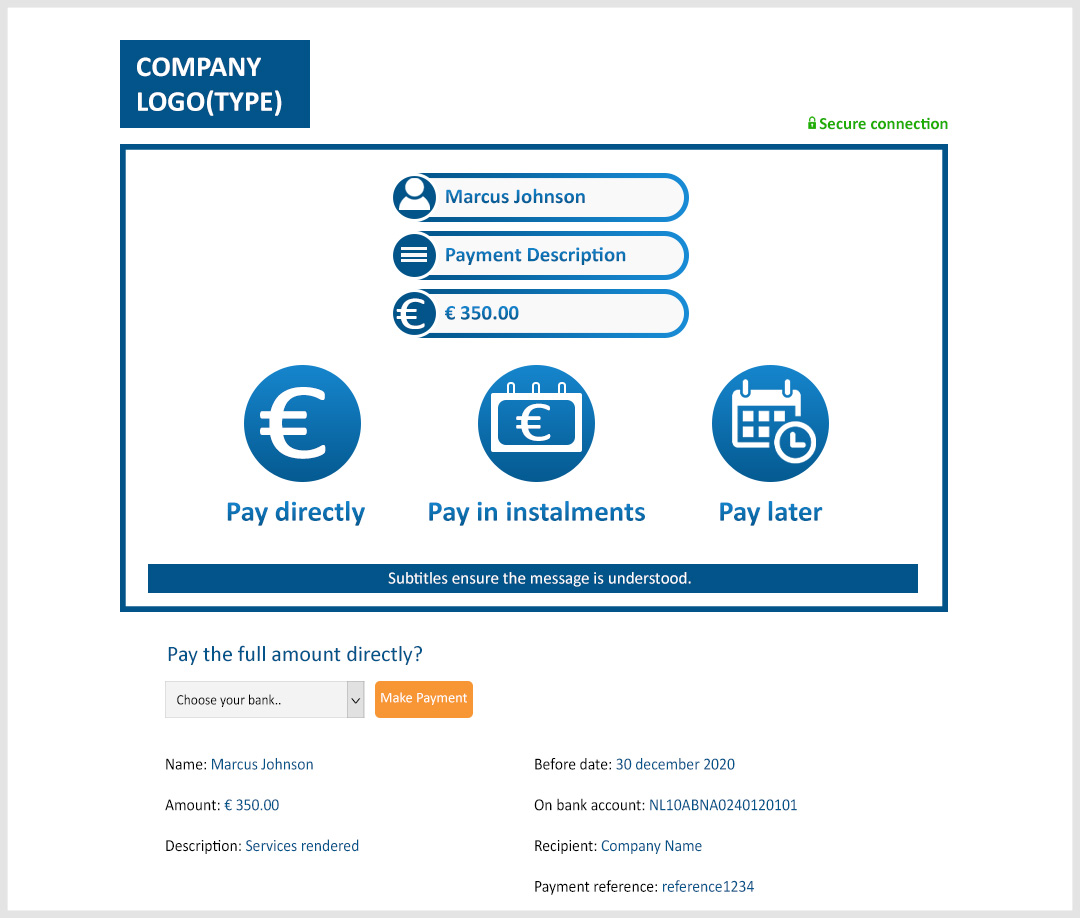

The most innovative tool in a self-service approach is perhaps interactive video. These are highly personalized videos that clearly explain the situation to the user and offer all the previously mentioned payment options from within the video.

These are clickable Choose Your Own Adventure style videos that guide the customers from start to finish. The very best videos include subtitles and multilingual support.

The very best videos include subtitles and multilingual support.

How interactive video works

The example below illustrates a case in which the customer has already clicked to see the video explanation and is now prompted to make a choice regarding the outstanding payment. Note how the customer’s name, payment description, and the amount are summarized within the video. The payment buttons are large, and the texts are concise. Moreover, the ability to click within the video and go back in case of a mistake, makes for a carefully guided process from the initial introduction all the way to the making of a final decision.

For a demonstration of our approach to interactive video, request a demo.

Self-service is good for everyone

The social impact of a self-service approach is felt by society at large. By making bills and payment options more understandable to consumers, a self-service approach to debt collection mitigates some of the root causes of problematic debt.

By offering customers ways to help themselves, b2b and b2c businesses as well as debt collection agencies are also better able to increase the productivity of their employees by allowing them to direct their focus on specific cases rather than chasing every open invoice.

Simply put, a self-service approach is good for business. Once implemented,

- Customers are more likely to pay their bills (on time).

- Businesses see increased customer retention and reduced churn.

- Staff will only ever need to reach out to the most problematic of customers.

- Debt collectors reduce dunning costs and increase revenue per employee.

In summary

Many households have debts that limit their ability to pay their bills and when customers don’t pay, businesses suffer.

As business leaders, we should ask ourselves: are we in this for the money, or is there something more? The truth is we are in this together and the more we do to serve our customers, the more money we make.

It’s time to flip the script and meet customers halfway. The best way to do this is by providing them with the means of paying their (late) bills in ways that make financial sense.

Customers will appreciate the trust and flexibility afforded to them when businesses enrich Artificial Intelligence and Machine Learning with Self-service.

Self-service options like interactive video landing pages are a more humane, sensible and socially sensitive approach to payment collection. An approach that yields results, saves money and retains customers.

Alphacomm: helping companies recover lost revenue

Alphacomm is a global partner in payment reminder services with over 20 years of experience. Our wide range of payment reminders include interactive video, voice messages, SMS and a digital assistant as well as personalized QR codes. We’re confident. Our tools are guaranteed to reduce the risk of non-payment, reduce DSO, and boost revenue.

If you’re ready to reduce payment delays and avoid write-offs, call us today on +31107989 501 to schedule a free consultation.

Self-service | Our moonshot

At Alphacomm, we aim to help consumers in ways that they understand. This is done through the effective use of technologies such as interactive video and with tools that give users the power to make their own financial decisions to their advantage.

The traditional approaches to resolving customer debt have often made things worse. When communities are riddled by debt, nobody wins.

At Alphacomm, we decided to do something about this. Our goal is to rid families of the burden of debt.

We have developed a hybrid approach that combines data together with the human touch, to empower consumers and provide them with the means to resolve debts as quickly and efficiently as possible.

We have further expanded on this approach by developing innovative tools like interactive video and self-service landing pages.

We’re looking to spread the word and share our experiences regarding self-service in credit management.

Together with our partners, we are going to eradicate debt in communities around the world.

If you found this article informative, please share it with your colleagues. If you’d like to chat to one of our experts about your payment fraud concerns, please give us a call on +31107989501.

About Alphacomm

Alphacomm is a global partner in all top up, reminder, dunning and payment challenges. Collectmaxx, our payment reminders solution, helps companies get paid faster, at lower costs, by utilizing modern communication channels, like interactive video, as well as the customer’s preferred payment methods. If you’re ready to give your customers the ultimate payment experience and boost brand loyalty, schedule a free consultation today.

Let's make it happen!

Say Hello!

Address

Scheepmakerspassage 183

3011 VH Rotterdam

The Netherlands

Business

Follow us

Address

Scheepmakerspassage 183

3011 VH Rotterdam

The Netherlands

Business

Follow us

© Copyright Alphacomm B.V. | Made with <3 in Rotterdam